APX Auto Payment Failures

1. Declined Due to Insufficient Funds, Refer to Customer or Generic Decline/ Unspecified Failure

In the event of a payment failure due to insufficient funds or an unspecified error, the system will attempt to debit the same debtor payment method up to three times, with each attempt spaced seven days apart. This approach minimizes dishonour occurrences and provides adequate time for client follow-up.

- If a new payment method is added, or if the existing debtor payment method is re-entered, the attempt count will reset to the first attempt.

- On the third consecutive failed attempt, the merchant administrator will receive an Auto Pay dishonour notification, and the APX Auto functionality will be disabled for that client.

- If the failure reason is listed as Generic Decline, the bank has not specified the reason for the decline. In such cases, it is recommended to instruct the debtor to contact their bank for further clarification on the declined transaction.

2. Declined Due to Expired Card, Payer has closed account or Invalid Details

If a payment fails due to invalid details, expired card, closed account, or the bank disallowing direct debits, the system will not retry the transaction. The associated payment method will be deleted to prevent further debit attempts. If a valid payment method is still not available by the next main processor run, your merchant administrator will receive an APX Auto Invoice with no Payment Method notification indicating no payment method is on file.

APXAuto and the Engagement payment method function as a single, unified system. Accordingly, if a payment fails due to reasons such as an expired card, invalid payment details, or a closed account, the affected payment method is automatically removed from both the Debtor Payment page in your Apxium Dashboard and the client’s engagement portal.

Additionally, both the merchant administrator and the client will receive a payment failure notice.

See also Payment Rejection Notification Emails

Direct Debit Dishonour Fee

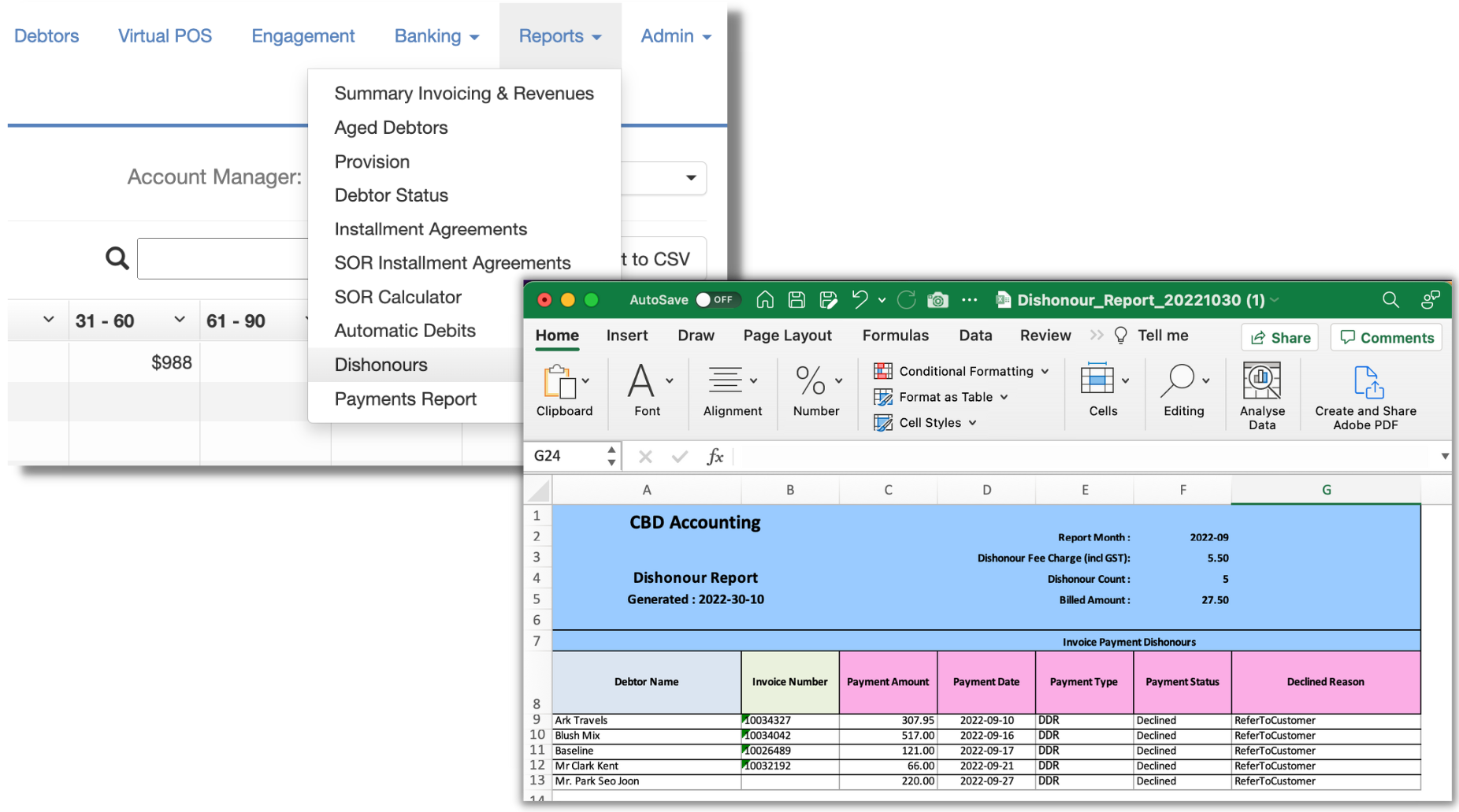

A $5.50 Dishonour fee to the merchant will incur per Direct Debit dishonour. You may pass this on to your client if you wish.

A Dishonour report is generated on a monthly basis and this is available in the Reports section of your dashboard.

![apxium-logo.png]](https://support.apxium.com/hs-fs/hubfs/Logos/apxium-logo.png?width=144&height=50&name=apxium-logo.png)