Xero Rule - Passing on merchant fees

How to set up reconciliation of Apxium processed payments in Xero.

Consistent will all banking payments processors, settlements from Apxium arrive in your bank

account as two bulk settlements, one for credit card transactions and one for direct debit of

bank accounts.

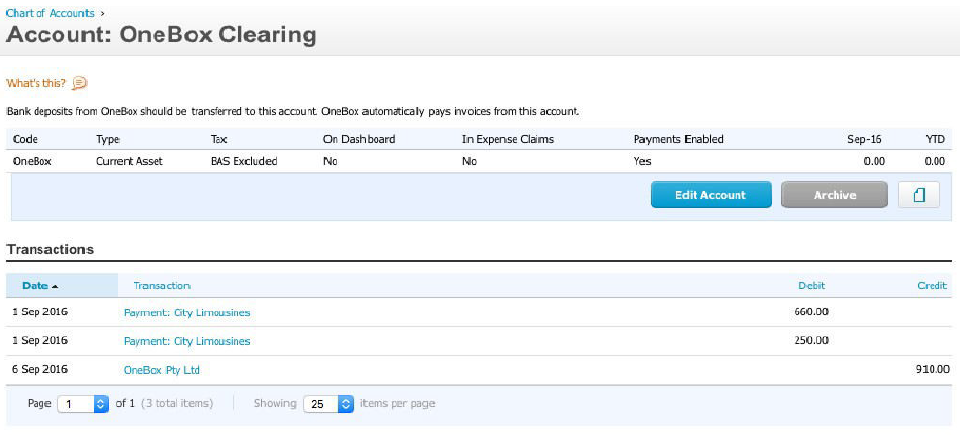

In order to accurately account for the allocation of debtor payments and potential transaction

fees Apxium programmatically creates two accounts. One called the Apxium Clearing Account

and another called the Apxium Fee Account. Note: Both the account code and account name

can be changed to suit your own conventions.

To balance the invoice allocation journal entries from the Clearing Account, the Bank Account

bulk settlement needs to be journaled from the Bank Account to the Apxium Clearing Account.

When this is done on a daily basis, we will also at the same time journal your client’s payments

to the relevant invoices in Xero.

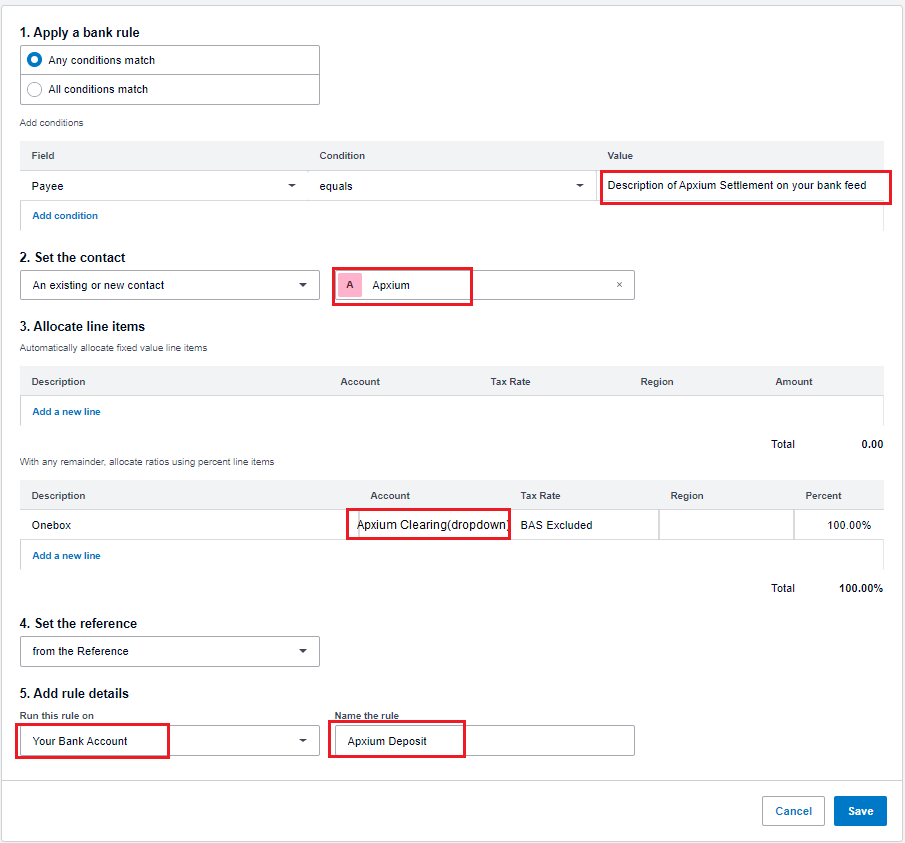

Therefore, you must create a business rule in Xero to teach the system that Apxium bulk

settlements to the Bank Account are always to be applied to the Apxium Clearing Account. You

will only need to do this once for credit card settlement and direct debit settlement, hence two

rule entries will be needed.

You will receive two types of bulk settlements. One for all credit card transactions and one for all

direct debits of bank account transactions.

Please follow the process below to create the business rule:

1) Find the Apxium deposit in your Xero settlement Bank Account. The actual deposit will

vary in its final form depending on the banking relationships that you have, however

they will always remain the same for each type of deposit. Credit card deposits will likely be referenced as “Merchant Settlement” or with "Till Payments" / "Till Funding" (for Till merchants) and Direct Debit transactions from bank accounts will likely be referenced “DD APX-XXXXX”. Click on the “Create Rule” link. You will need to do this twice, once for credit card deposits and once for bank account deposits.

This also applies to AMEX pass-on fees for merchants using the Till Payments or Nuvei MID facility.

2) Key in the business rules as shown. Note that the Apxium bulk settlement must be

applied to the Apxium Clearing Account. The Apxium Clearing Account was

programmatically created by us the first time we were granted token access. You do not

need to create a clearing account!

a. On your Bank Reconciliation page in Xero, select “Manage Account”.

b. Select bank rules from the menu.

c. Create Rule.

Note: If you are using Till MID Facility, you can put Till Payments

Value: it applies on both Credit Card and Direct Debit

3) Once saved you will need to click “OK” every day for each credit card and direct debit

bulk settlement and Xero will know to apply the settlements to the Apxium Clearing

Account. The process of journaling funds from the bank account to the clearing account

will rebalance the clearing account on a daily basis.

4) When this is done on a daily basis, we will also at the same time journal your client’s

payments to the relevant invoices in Xero.

5) You are able to review clearing account and compare it to your settlement report. The

Apxium Clearing Account can be accessed via the merchant admin main menu. This will

show you the invoice allocations.

6) As you are passing on part of the merchant fees, your clients will be paying more for the

invoice than just the face value of the invoice. The additional charges that your clients

paid will be journaled into the Apxium Fee account. The fee account continues to grow

as further payments are made by your clients. You do not need to do anything with this

account however you might wish to use it to offset part of the fees for merchant services

that are debited by the bank at month's end.

IMPORTANT:

Before removing payments on an invoice in Xero, please check the payment reference field and

if it starts with "Apxium-", then please do NOT remove it. Payments starting with "Apxium-" are

payments exported from the Apxium system to Xero and represent real money transactions

that have fees and associated GST. If there is a pressing need to remove a payment with a

reference that starts with "Axpium-", then please contact Apxium support beforehand and we

will work with you to find a solution.

![apxium-logo.png]](https://support.apxium.com/hs-fs/hubfs/Logos/apxium-logo.png?width=144&height=50&name=apxium-logo.png)