Payrix - ACH Reject Codes

What does each ACH reject code in Payrix means?

Refer to Payrix support document (ACH Rejects & Returns):

https://resource.payrix.com/v1/docs/en/disbursement-rejects-and-returns-payout-rejects

If a hold is placed on a bank account as a result of a return, you will need to reach out to Payrix support to resolve the hold. The returns are separated into three categories: NSF, BAD ACCOUNT, AND UNAUTHORIZED. A separate action is taken per category.

-

NSF: The system will not place a hold. Future transactions are permitted.

-

BAD ACCOUNT: A block is placed on the account. The merchant will need to provide a new bank account

-

UNAUTHORIZED: A block is placed on the account. A letter needs to be provided to support indicating that the reason for the return no longer applies.

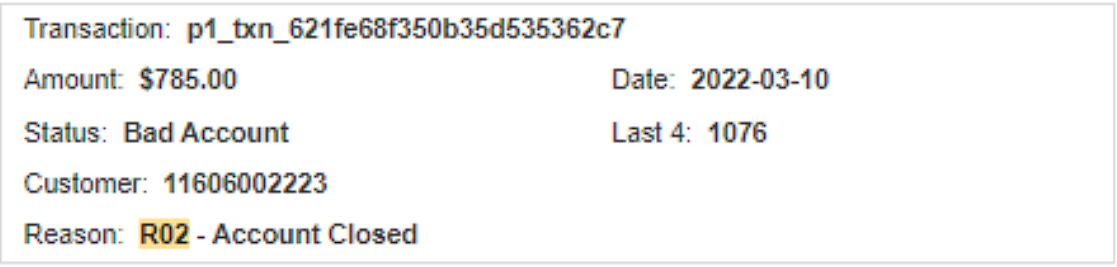

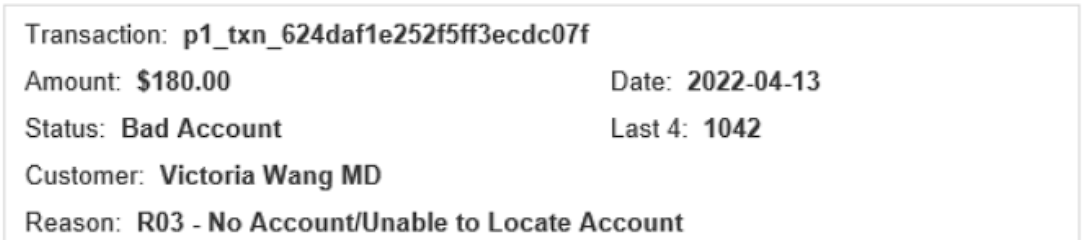

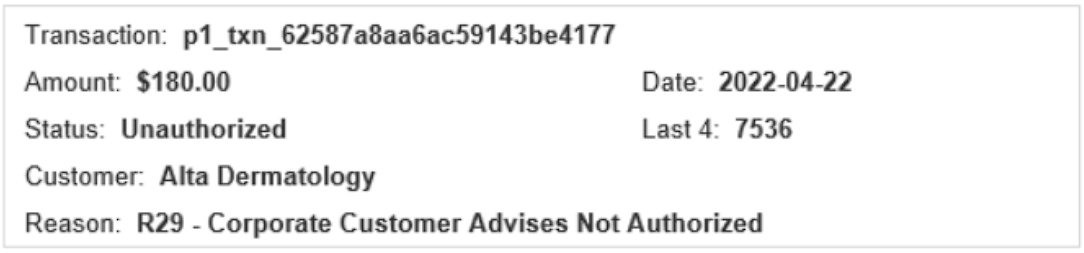

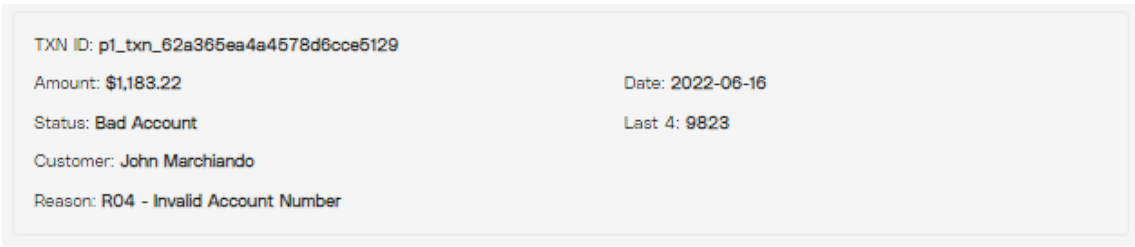

Sample of the usual Payrix Notification to Merchants:

The reject code R02, R03 R04 means BAD ACCOUNT and a block is placed on the account that cannot be removed.

-

This requires the client to check and verify their bank account info that is in the portal and correct the bank information. Once corrected, the same account can be used moving forward.

The reject code R10 and R29 are UNAUTHORIZED code that is returned from the bank and a block is placed.

-

To remove this block, the client will need to provide a bank letter from their bank stating this transaction is authorized. Once that bank letter is provided to Payrix via a support ticket, they will then remove the block and the payout will proceed as normal.

Unauthorized codes usually gets the message: ‘E-check processing disabled for this account’.

Error indicates that there is a block within Payrix on the bank account being used for the transaction. In most instances, this is due to a return that was received in a previous eCheck transaction.

The block is automatically placed by the system to prevent future returns. If Payrix receives too many returns, it could be in violation of their agreement with NACHA.

May need to confirm if the client that is using the Corporate Account has the Authorization to use it and if the ACH account is active.

![apxium-logo.png]](https://support.apxium.com/hs-fs/hubfs/Logos/apxium-logo.png?width=144&height=50&name=apxium-logo.png)