Instructions on how to fill out the Till Application Form - Australia

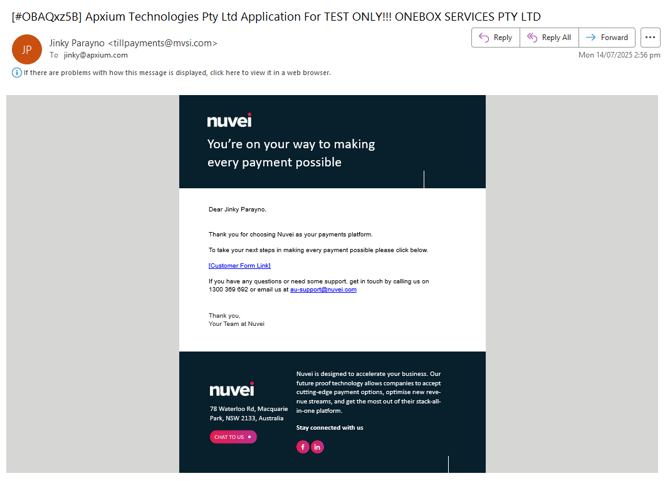

You should receive an email from tillpayments@mvsi.com to access the MID facility application form.

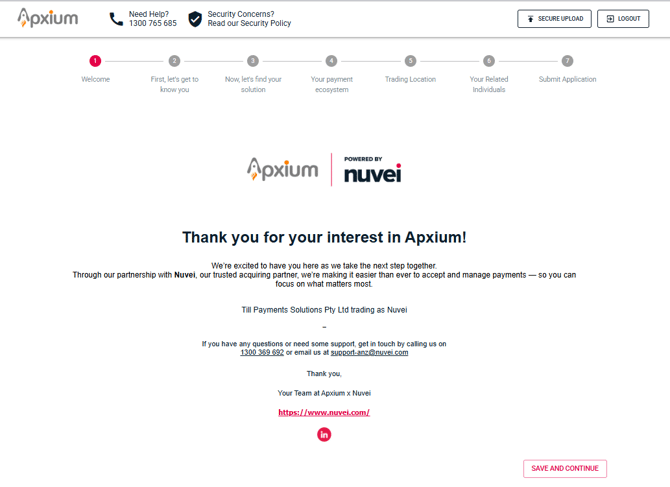

1. Welcome Page

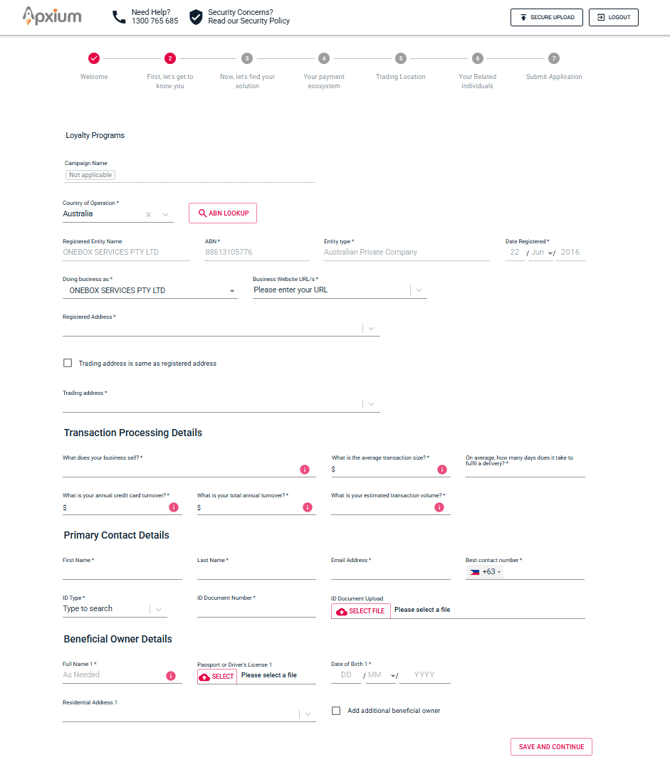

2. First, let's get to know you

Please review the information and fill out any remaining required fields related to your business details.

Transaction Processing Details

We recommend entering an approximate number based on your expected transaction volume. It doesn’t need to be exact.

3. Next, let's go to your business

In this section of the Till application, you're asked to provide some basic information about your payment preferences.

Which Schemes Will You Be Accepting?

-

By default, Visa and Mastercard are selected.

-

If you plan to accept American Express (Amex), tick the box.

-

If you do not want to accept Amex, simply leave it unticked.

If You Choose to Accept Amex

Once Amex is selected, you’ll need to choose how Amex will be funded from the dropdown menu:

-

Nuvei - Select this if you wish to activate Amex using a Till/Nuvei credit card MID (2.2% including GST). You can choose to either pass this fee on to your customers or absorb the cost.

-

Amex - Select this if you already have an existing American Express merchant facility. You’ll need to enter your Amex Merchant ID in the field provided.

Payment Functionality

-

Do you require refunds?

Defaulted as No. If a refund is ever needed for a payment made through the Apxium portal, we generally recommend processing it on your side, as the funds are settled directly into your bank account. -

Do you require pre-authorisation?

Defaulted as No. This setting is not required for Apxium’s payment process. -

Do you require surcharging?

Defaulted as No, as Apxium will manage and configure surcharging for you during setup.

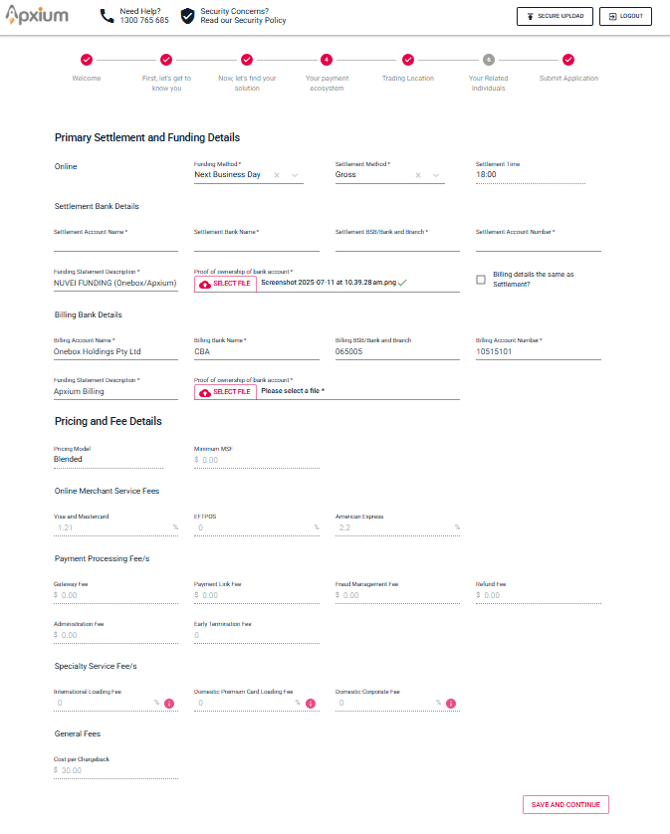

4. Your payment ecosystem

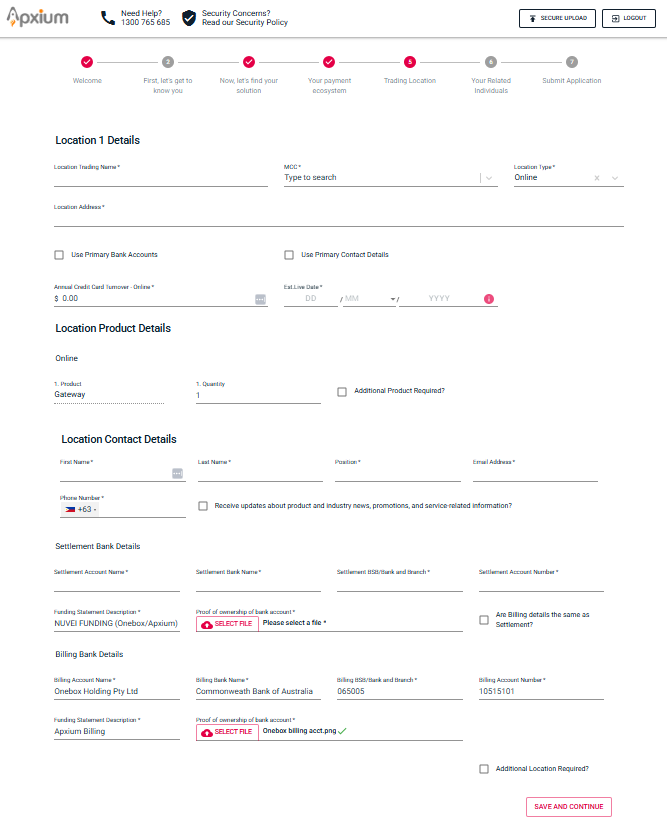

Settlement Bank Details

Please provide the bank information for the account that you wish to settle.

Funding Statement Description: Please input NUVEI FUNDING (Onebox/Apxium). This will appear on your firm's bank statement when funded.

Important Reminder: In line with our partner agreement with Till, the billing bank details must remain as Onebox Holding Pty Ltd and should not be changed.

Pricing and Fee Details

Please review the fees listed on this page. If you have any questions, reach out to your Onboarding Specialist.

Other Fee Details: Please refer to Apxium Services Agreement for other Apxium fees.

5. Trading Location

Important: In line with our partner agreement with Till, the billing bank details must remain as Onebox Holding Pty Ltd and should not be changed. This is to avoid any unintended charges from Till/Nuvei.

6. Your Related Individuals

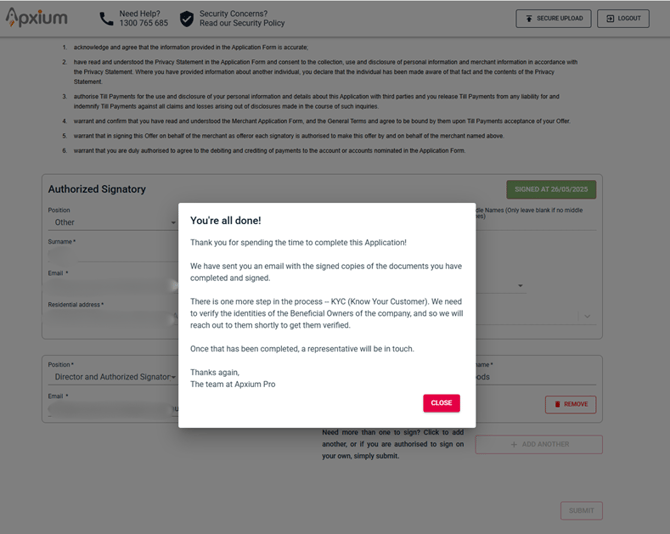

7. Submit Application

Once you’ve reviewed the information and are satisfied with the details provided, click "Submit" to proceed.

After submitting the online form, the KYC team will contact you and start processing the application.

They would also ask you to provide the following documents for the KYC process.

-

An ID

-

Proof of bank

-

And then relevant company documents such as a trust deed etc.

Please refer to more information on this page: Till MID Facility - Guide to a Successful Merchant Application

![apxium-logo.png]](https://support.apxium.com/hs-fs/hubfs/Logos/apxium-logo.png?width=144&height=50&name=apxium-logo.png)